r&d tax credit calculation example

What are the methods of computation of R D Tax Credits. For example prototypes that are created and used in rd and subsequently sold to customers can be included in the tax credit.

Interest Tax Shield Formula And Calculator Excel Template

Check if youre eligible today.

. SME for RD tax relief purposes is a company which together with other group and linked enterprises does not exceed. Startup RD Tax Credit Calculator. Now as appears from the above youve carried out RD activities and youve calculated the qualifying expenditure to be 100000.

The Inflation Reduction Act of 2022 passed August 12 2022 increases the RD Tax Credit amount from 250000 to 500000. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. Let us explain research and development RD tax credits simply and show you ways to continue your investment in innovation.

If the company spent 100000 on RD projects in a year then its potential RD Credit would be 33350. 500 employees 100m turnover 86m balance sheet. Below are the various examples of how a claim value is calculated.

Youll therefore multiply this amount by 130 and. There are two methods of computation of R D tax credits -Traditional Method and Alternative Simplified Credit. If there is a 100000 payment to a subcontractor of which half is for RD activities the calculation would be 100000 x 50 50000 x 65 32500.

SME Scheme calculation for a company that was profitable and spent 100000 on qualifying RD activities in a given. We will update our. SME RD tax credit calculations - Detailed Example Step 1.

This credit appears in the Internal Revenue Code section 41 and is. The RRC is an incremental credit that equals 20 of a taxpayers current-year QREs that exceed a base amount which is determined by applying the taxpayers historical percentage of gross. This can be done for the current.

Add the annual QREs over the previous four years. Loss Making SME Calculation Large Companies RDEC. Find the fixed base percentage.

RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. RD Tax Credit Calculator. Assuming your business fits these criteria you can check below for example calculations for RD tax credits.

70000 - 24167 45833 x 14. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. A Profitable SME RD Tax Credit Calculation Lets assume the following.

RD Tax Credit Calculation Examples. Calculate profitslosses subject to corporation tax before RD tax relief The preparation of a companys tax return CT600 is. Deduct an extra 130 of their qualifying costs from their yearly profit as well as the normal 100 deduction to make a total 230 deduction.

SME RD relief allows companies to. Add the total QREs for the current tax year.

R D Tax Credit Calculation Methods Adp

Net Operating Losses Deferred Tax Assets Tutorial

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Adp

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

A Simple Guide To The R D Tax Credit Bench Accounting

Depreciation Tax Shield Formula And Calculator Excel Template

R D Tax Credit Calculation Examples Mpa

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

R D Tax Credit Calculation Adp

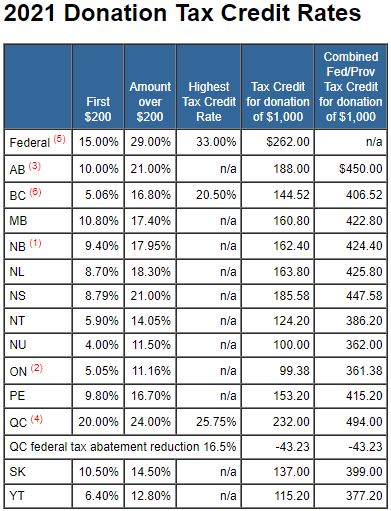

Taxtips Ca Donation Tax Credit Rates For 2021

Income Tax Calculator App Concept Calculator App Tax App App

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

The Amt And The Minimum Tax Credit Strategic Finance

Cost Of Debt Kd Formula And Calculator Excel Template

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)